Disclaimer: The following is for informational purposes only. It is not intended to constitute legal advice, or to recommend a course of action, and does not create an attorney-client relationship between the reader and Renuka Somers, or Somers Tax Law, PLLC.

Australians love to travel. You’ll find us in every corner of the globe, especially in the United Kingdom and the United States. However, if a beneficiary of your estate is a “U.S. Person” – i.e. a U.S. citizen or resident, you may need to rethink your estate plan. Here’s why: Taxes. In both countries.

- You may have U.S. Estate tax implications if you hold assets in the U.S. So, if you have significant wealth (in Australian and/or in the U.S.), appropriate structuring is imperative for both you, and your U.S. heirs.

- Your U.S. beneficiary may have additional tax exposure in Australia and/or in the U.S., depending on the type of assets they inherit, whether they are a resident or nonresident of Australia, and their relationship to you.

The U.S. Position:

The Federal Estate and Gift Tax

In the U.S. a 40% Federal estate and gift tax applies to estates valued at over USD $13.61 million[1] for individual “U.S. persons”[2].

- For U.S. citizens, this applies to worldwide assets, regardless of residency.

- The value of gifts made during life in excess of the “annual exclusion” (i.e. the value of tax-free gifts that a U.S. person can make each year[3]) is subtracted from this threshold.

- The Federal estate tax exemption is set to reduce to approximately. USD $7 million from January 1, 2026.

The threshold is much lower for “non-resident aliens” (i.e. non-resident non-citizens of the U.S.) (“NRAs”), who are subject to Federal estate tax where the value of their U.S.-situs assets exceeds USD $60,000. Such assets include:

- Real estate located in the U.S.

- Shares in U.S. corporations

- Tangible personal property

- Bank accounts (U.S. banks)

Australians enjoy some relief from the NRA estate tax, as the US-Australian “Estate Tax Treaty” provides for the U.S. Federal estate tax exemption applicable to U.S. persons to be applied to the U.S. situs assets of Australian NRAs as a proportion of their worldwide assets[4] – thereby reducing an Australian NRA’s U.S. estate tax exposure.

Max. Unified credit x (Value of U.S. situs assets / Value of entire gross worldwide estate)

Note: The Executor must file Form 706-NA, United States Estate (and Generation-Skipping) Tax Return, Estate of a nonresident not a citizen of the United States and invoke the Treaty-based position to claim this concession[5].

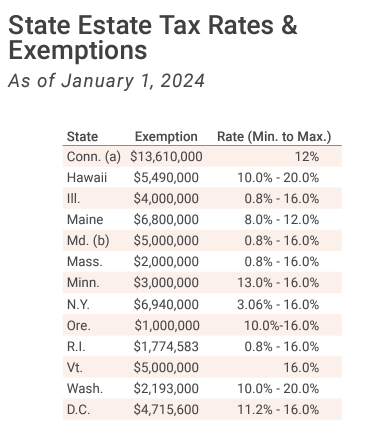

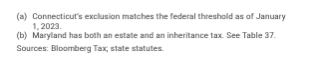

State Estate and Inheritance Taxes

Some individual States impose estate taxes (payable by the estate) and/or an inheritance tax (payable by the beneficiary).

The exemptions and rates vary from State to State. In New York, the 2024 New York State estate tax exemption is USD $6.94 million and the estate tax rates range from 3.06% to 16%[6]. In some States, the rate can be as high as 20%.

State Estate Taxes:

Tax Foundation: Facts & Figures How does your State compare? 2024, Table 36

State Inheritance Taxes:

Tax Foundation: Facts & Figures How does your State compare? 2024, Table 37

🚩 U.S. Heirs: Inheritance and Ongoing IRS Reporting Obligations:

If the aggregate amount received by a U.S. Person from an NRA (during their life) or foreign estate exceeds USD $100,000 during a taxable year, the U.S. Person must report the gift/ bequest to the IRS[7].

Depending on the nature of the assets and structure in which they are held, the U.S. beneficiary may have:

- ongoing IRS income tax and reporting obligations with respect to:

- Foreign bank accounts and foreign financial accounts (FBAR)

- Specified foreign financial assets (IRS From 8938)

- Passive Foreign Investment Company (“PFIC”) reporting (IRS Form 8621)

- Controlled Foreign Corporation (“CFC”) reporting (IRS Form 5471)

- Foreign trust reporting (IRS Forms 3520, and 3520-A)

- State Estate and Inheritance tax reporting.

- Federal gift tax exposure (40%) for “covered gifts or bequests” if the donor / deceased was formerly a U.S. person who was a “covered expatriate” when they surrendered U.S. citizenship / green card[8].

- Their own Federal and State estate tax exposure when they pass.

The Australian Position

In contrast to the U.S. position, there is no direct “estate tax” in Australia. However, there can be Australian tax implications, depending on:

- whether a beneficiary is a resident or a nonresident of Australia

- the nature of the asset inherited by that beneficiary

- whether a beneficiary is a superannuation tax dependent.

We explore the comparative tax implications in Part 2 of this series.

Endnotes:

1. 2024 Gift and Estate Tax Exemption

2. A U.S. citizen or resident, domestic partnership, domestic corporation, domestic estate, or domestic trust: I.R.C. § 7701(a)(30); Treas. Reg. § 301.7701-7(d)(1)(i)

3. USD $18,000 for 2024

4. Article IV, Convention between the Government of the Commonwealth of Australia and the Government of the United States of America for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on the Estates of Deceased Persons: Australian Treaty Series 1953 No 4.

5. IRS form 8833, Treaty-Based Return Position Disclosure

6. https://www.tax.ny.gov/pit/estate/etidx.htm

7. IRS Form 3520

8. I.R.C. §§ 877A, 2801.