Disclaimer: The following is for informational purposes only. It is not intended to constitute legal advice, or to recommend a course of action, and does not create an attorney-client relationship between the reader and Renuka Somers, or Somers Tax Law, PLLC.

A“PFIC” (passive foreign investment company)is generally, a foreign corporation which in any year either has passive income equal to 75% of its gross income or passive assets equal to 50% of its total assets. ‘Passive income’ is income derived from real estate and business investments in which the corporation is not actively involved, including rents, dividends and interest income.

A U.S. Person is required to disclose an interest in a “PFIC” by filing IRS Form 8621 in relevant tax years. Failure to file Form 8621 within the prescribed time frame carries a penalty of $10,000 (up to a maximum of $50,000) for each tax year during which the failure exists.

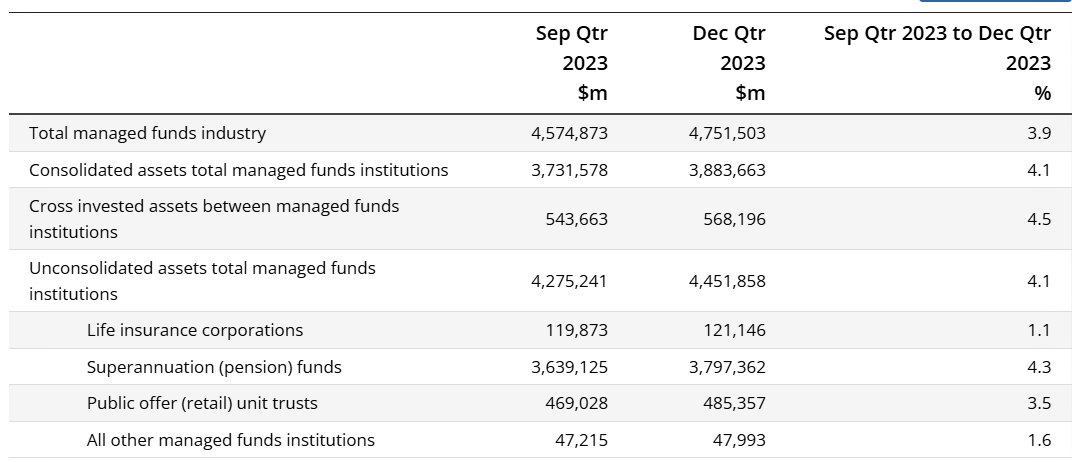

Commonly, managed funds and ETFs come within the PFIC rules. Such investments are often favored by Australians. The Australian Bureau of Statistics reported that during the December 2023 quarter the total managed funds industry rose $176.6b (3.9%) to $4,751.5b funds under management:

Table 1: Managed Funds, Australia. Reference Period: December 2023

Here’s the danger: these investments may have been acquired prior to an Australian moving to the U.S., may have been inherited by a U.S. Person from an Australian, or may be held by an Australian trust of which the U.S. Person is a beneficiary.

A U.S. Person can elect to treat a PFIC as a Qualified Electing Fund (“QEF”) to include only their pro-rata share of the PFIC’s earnings and profits annually in income. If a QEF election is not made with respect to the Trust, any “excess distribution” is subject to tax at the highest rate applicable to ordinary income (37% for 2024), plus an interest charge on the tax deferral benefit.

Alternatively, the U.S. Person can make a “mark-to-market” election to include the annual increase/decrease in the fair market value of the PFIC stock in income. Any gains or losses on the sale or other disposition of marketable stock in a PFIC with respect to which a mark-to-market election is in effect, can be treated as ordinary income and losses.

Where a foreign (for example, Australian discretionary) Trust holds managed funds or shares in a company that is a corporate beneficiary, there are further complications that need to be addressed, where the trust is controlled by a U.S. Person or a U.S. Person is a beneficiary or grantor of that trust.